mass tax connect certificate of good standing

For example the certification of your companys. Please note that account information for tax year 2010 and after will be carried over.

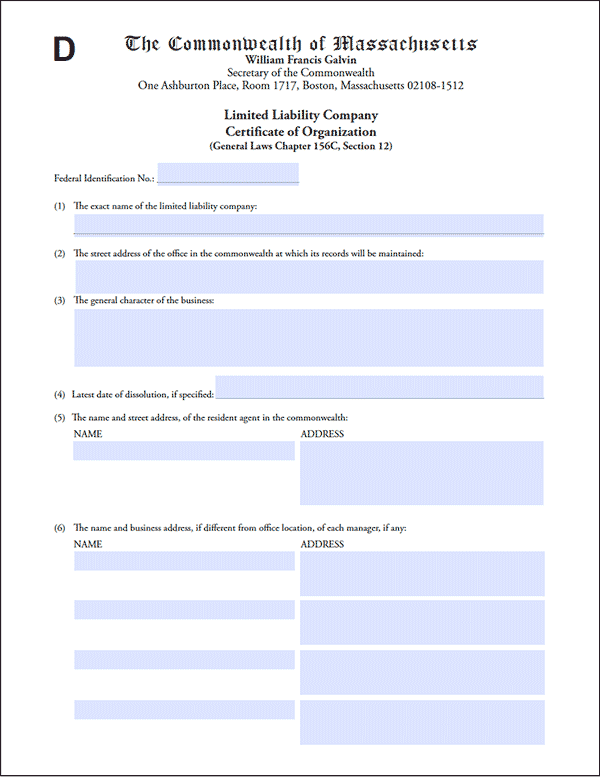

Llc Massachusetts How To Start An Llc In Massachusetts Truic

Requesting Tax StatusTax Good Standings from MA Dept of Revenue 1.

. In order to be in Good Standing a Massachusetts Corporation or LLC must be in compliance with the following. The Annual Certifications of Entity Tax Status as of January 1 of each year must be filed on or before the following April 1. MassTaxConnects Paid Family and Medical Leave PFML videos are.

How to File a Return and Remit a. You can order a certificate of good standing in the Commonwealth of Massachusetts by mail in person or online but we. Under Individual choose Request a certificate of good standing.

How to Get a Massachusetts Certificate of Good Standing. For further information call 617 887-6367. How do I delete a payment.

The payments must have a status of Submitted to be deleted. How to Register for Paid Family and Medical Leave Contributions. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Your support ID is. Corporations often need Certificates of Good Standing in order to obtain financing renew licenses or enter into other business transactions. View Sample of Certificate of Good Standing Please submit the certificate to.

Please enable JavaScript to view the page content. Massachusetts Certificate Tax Form. Most states want to see a certificate of good standing or its equivalent before allowing a company to do business in that state as a.

Revenue PO Box 7066 Boston MA 02204 or fax to 617 887-6262. Once your business remains compliant with the. Obtaining Good Standing Certificate in Massachusetts.

Httpsmtcdorstatemausmtc_ or search for mass tax connect 2. If you must apply by paper select Request for a Certificate of Good Standing andor Tax Compliance or Waiver of Corporate Tax Lien. When completing this form be sure to.

This video tutorial shows you how to request a Certificate of Good Standing from the MassTaxConnect homepageSubscribe to DOR on Social MediaYouTubehttpsw. Payments in MassTaxConnect can be deleted from the Submissions screen. Processing of a paper application can.

Your support ID is. Manage account access for tax preparers electronically. Order Your Massachusetts Certificate of Good Standing.

A Certificate of Good Standing-Tax Compliance or a Corporate Tax Lien Waiver is the answer when individuals corporations and other organizations need proof theyve filed. Please enable JavaScript to view the page content. To request a Certificate of Good.

Massachusetts Department of Revenue Request for a Certificate of Good Standing andor Tax Compliance or Waiver of Corporate Tax Lien PO Box 7073 Boston MA 02204. The filing fee is 125 for corporations and 500 for LLCs. A Certificate of Good Standing from DOR is required for Training Providers to meet DOR compliance.

Penalty and interest calculator. The Foreign or Domestic company must be registered as a legal entity with the.

How To Get A Certificate Of Good Standing In Your State Forbes Advisor

How To Log In To Masstaxconnect For The First Time Youtube

True North Fitness Home Facebook

The Simple Secret To Getting More Opportunities At Work Forbes Marketing Leadership

Introducing Cobrabraids Tech Bracelet With Up To 10 Feet Of 550 Paracord And Embedded In The Bracelet Is A 4gb Usb Drive Save Yo Pulseiras Pendrive Bracelete

Annuity Taxation How Various Annuities Are Taxed

This Spanish Cottage Is Any Minimalist S Dream House Spanish Cottage Modern Cabin House Design

Opseu Sefpo Faculty Members Issue Updated Report On State Of Colleges Opseu Sefpo

How To Log In To Masstaxconnect For The First Time Youtube

Sales And Use Tax For Businesses Mass Gov

Certificate Of Good Standing Massachusetts Truic

What Is A B Corp Advantages And Requirements

Massachusetts Sales Tax Small Business Guide Truic

Massachusetts Short Term Rental Tax Guide Weneedavacation Com